Ripple Whitepaper

Abstract

While several consensus algorithms exist for the Byzantine Generals Problem, specifically as it pertains to distributed payment systems, many suffer from high latency induced by the requirement that all nodes within the network communicate synchronously.

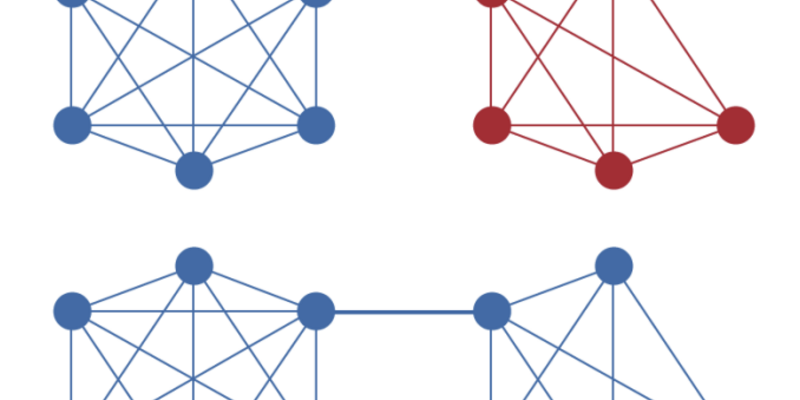

In this work, we present a novel consensus algorithm that circumvents this requirement by utilizing collectively-trusted subnetworks within the larger network. We show that the “trust” required of these subnetworks is in fact minimal and can be further reduced with principled choice of the member nodes. In addition, we show that minimal connectivity is required to maintain agreement throughout the whole network.

The result is a low-latency consensus algorithm which still maintains robustness in the face of Byzantine failures. We present this algorithm in its embodiment in the Ripple Protocol

Introduction

Interest and research in distributed consensus systems has increased markedly in recent years, with a central focus being on distributed payment networks. Such networks allow for fast, low-cost transactions which are not controlled by a centralized source. While the economic benefits and drawbacks of such a system are worthy of much research in and of themselves, this work focuses on some of the technical challenges that all distributed payment systems must face. While these problems are varied, we group them into three main categories: correctness, agreement, and utility. By correctness, we mean that it is necessary for a distributed system to be able to discern the difference between a correct and fraudulent transaction. In traditional fiduciary settings, this is done through trust between institutions and cryptographic signatures that guarantee a transaction is indeed coming from the institution that it claims to be coming from. In distributed systems, however, there is no such trust, as the identity of any and all members in the network may not even be known. Therefore, alternative methods for correctness must be This paper does not reflect the current state of the ledger consensus protocol or its analysis. We will continue hosting this draft for historical interest, but it SHOULD NOT be used as a reference.

Agreement refers to the problem of maintaining a single global truth in the face of a decentralized accounting system. While similar to the correctness problem, the difference lies in the fact that while a malicious user of the network may be unable to create a fraudulent transaction (defying correctness), it may be able to create multiple correct transactions that are somehow unaware of each other, and thus combine to create a fraudulent act. For example, a malicious user may make two simultaneous purchases, with only enough funds in their account to cover each purchase individually, but not both together. Thus each transaction by itself is correct, but if executed simultaneously in such a way that the distributed network as a whole is unaware of both, a clear problem arises, commonly referred to as the “Double-Spend Problem” [1]. Thus the agreement problem can be summarized as the requirement that only one set of globally recognized transactions exist in the network. Utility is a slightly more abstract problem, which we define generally as the “usefulness” of a distributed payment system, but which in practice most often simplifies to the latency of the system. A distributed system that is both correct and in agreement but which requires one year to process a transaction, for example, is obviously an inviable payment system. Additional aspects of utility may include the level of computing power required to participate in the correctness and agreement processes or the technical proficiency required of an end user to avoid being defrauded in the network. Many of these issues have been explored long before the advent of modern distributed computer systems, via a problem known as the “Byzantine Generals Problem”.

In this problem, a group of generals each control a portion of an army and must coordinate an attack by sending messengers to each other. Because the generals are in unfamiliar and hostile territory, messengers may fail to reach their destination (just as nodes in a distributed network may fail, or send corrupted data instead of the intended message). An additional aspect of the problem is that some of the generals may be traitors, either individually, or conspiring together, and so messages may arrive which are intended to create a false plan that is doomed to failure for the loyal generals (just as malicious members of a distributed system may attempt to convince the system to accept fraudulent transactions, or multiple versions of the same truthful transaction that would result in a double-spend). Thus a distributed payment system must be robust both in the face of standard failures, and so-called “Byzantine” failures, which may be coordinated and originate from multiple sources in the network. In this work, we analyze one particular implementation of a distributed payment system: the Ripple Protocol. We focus on the algorithms utilized to achieve the above goals of correctness, agreement, and utility, and show that all are met (within necessary and predetermined tolerance thresholds, which are well-understood). In addition, we provide code that simulates the consensus process with parameterizable network size, number of malicious users, and message-sending latencies.

Want to find a web3 job?

| Job Position and Company | Location | Tags | Posted | Apply |

|---|---|---|---|---|

| Latin America Latin America Latin America | Apply | |||

| | United States | Apply | ||

| Remote | Apply | ||

| by Metana | Info | ||

| | San Francisco, CA, United States | Apply | ||

| Los Angeles, CA, United States | Apply | |||

| | Remote | Apply | ||

| | New York, United States | Apply | ||

| Remote | Apply | |||

| | New York, United States | Apply | ||

| New York, United States | Apply |